Discover HRIS: Simplify Your Payroll and Benefits Access

- Chelsea Cuevas

- October 14, 2025

- Accounting, Business, ERP, General, Payroll, Software, Tech Trends

- ERP, ERPatSystem, HRIS, HRTech, SoftwareDevelopment

- 0 Comments

Understanding HRIS and Its Impact on Payroll & Benefits

A Human Resource Information System (HRIS) is a software solution that simplifies HR processes, including payroll management, benefits administration, and employee records.

Why Does HRIS Make Payroll Easier?

- Automated Payroll Processing – HRIS ensures that salaries, deductions, and taxes are computed accurately, reducing errors and saving time.

- Transparent Payslips – Employees can access detailed breakdowns of their earnings, deductions, and benefits instead of just focusing on their net pay.

- Real-Time Access – Employees can view their payroll data anytime, eliminating the need to wait for printed payslips.

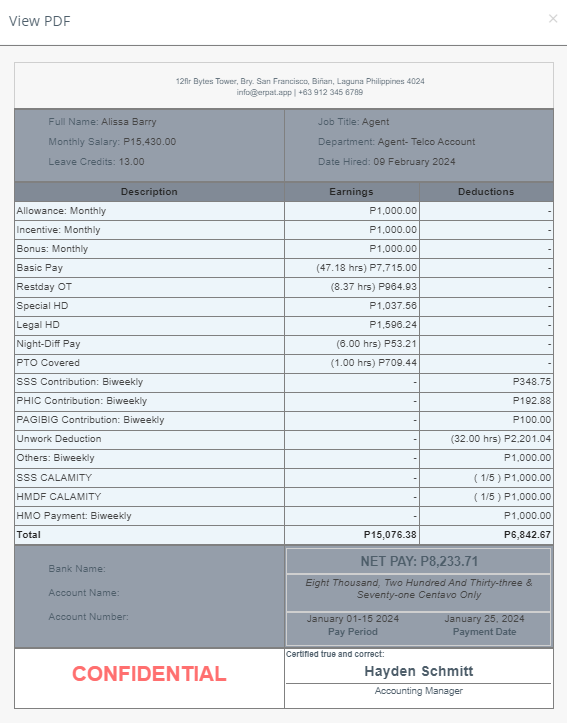

The Components of a Payslip

Understanding your payslip can greatly enhance your financial management. Let’s break down the key components you’ll find on a typical Filipino payslip:

1. Basic Salary:

Your basic salary is the foundation of your earnings, calculated based on your agreed-upon rate and the number of days or hours you’ve worked.

2. Allowances:

Allowances are additional payments on top of your basic salary. Common allowances include:

Covers commuting expenses.

Reimburses daily meal costs.

Assists with housing expenses.

ERPat: Syntry Payroll Sample

ERPat Syntry Payroll Sample. This payroll is customizable based on your preferences and our company’s branding.

3. Overtime Pay:

Overtime pay is compensation for hours worked beyond your regular schedule, usually at a higher rate.

Additional pay for hours worked beyond the standard work schedule.

Extra compensation for hours worked on designated rest days.

4. Holiday Pay:

Compensation for working during holidays:

Higher pay for working on special non-working holidays.

Premium pay for working on regular holidays.

5. Night Differential:

Additional pay for working night shifts, typically between 10 PM and 6 AM, to compensate for the inconvenience of working late hours.

6. Paid Time Off (PTO):

This includes paid leave days you are entitled to, such as vacation leave, sick leave, and personal leave. PTO ensures you receive your salary even when taking authorized time off.

7. Bonuses:

Bonuses are extra payments for performance or as part of your employment contract. These can include:

A mandatory bonus in the Philippines, equal to one-twelfth of your annual salary.

Rewards based on your job performance.

8. Statutory:

A mandatory withholdings that employers must deduct from an employee’s gross pay. These deductions are required by law and are intended to fund various government programs and services.

Loans provided by your employer.

Emergency loans from Pag-IBIG for disaster-related purposes.

Loans from Pag-IBIG for personal financial needs.

Loans from the Social Security System for short-term financial needs.

The total earnings before any deductions. It includes your basic salary, overtime pay, allowances, holiday pay, and any other additional earnings.

9. Loans

Deductions for repaying various loans:

Income tax based on your earnings.

Mandatory contributions to the Social Security System.

Contributions to the Home Development Mutual Fund.

Health insurance coverage deductions.

10. Gross Pay:

The total earnings before any deductions. It includes your basic salary, overtime pay, allowances, holiday pay, and any other additional earnings.

11. Net Taxable Income:

The portion of your gross pay that is subject to tax after allowable deductions, such as SSS, PhilHealth, and Pag-IBIG contributions.

12. Net Pay:

Deductions for repaying various loans:

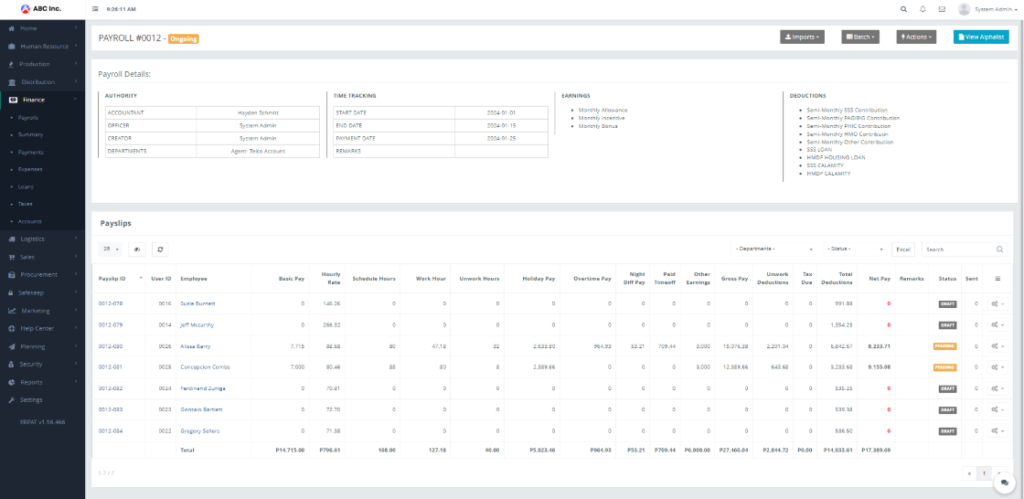

This payroll dashboard provides a quick view of payroll. We can see the creator, payment date, and a list of employees' payslips.

How HRIS Simplifies Payslip Understanding

An HRIS (Human Resource Information System) can greatly simplify understanding your payslip. Here’s how:

- Clear Breakdown of Earnings and Deductions: An HRIS provides a detailed breakdown of your earnings and deductions, making it easier to see how your net pay is calculated.

- Easy Access to Historical Payslips: HRIS allows you to access and review past payslips easily, helping you track changes over time.

- Real-Time Updates: With HRIS, any changes in salary, tax rates, or contributions are automatically updated, ensuring your payslip is always accurate.

- Personalized Insights: HRIS systems often include tools that show how different factors, such as overtime or allowances, impact your net pay, helping you make informed financial decisions.

What Our Users Say About ERPat

"Nung nagsimula kaming gumamit ng ERPat System, ang laki ng ginhawa! No more repetitive tasks. Mas smooth ang takbo ng trabaho namin, at mas madali na ang pag-track ng inventory at finances. Ang saya kasi ang daming oras na natitipid, mas marami kaming nagagawa. Kung naghahanap kayo ng ERP system na simple pero malakas ang impact, ito na ‘yun!"

"Honestly, ERPat by BytesCrafter has been a game-changer for us. Dati, puro manual tracking at spreadsheets ang gamit naming, sobrang nakakapagod at magulo! Ngayon, andali na lang, lahat nasa iisang system, at real-time pa ang updates. Hindi na ako nag-aalala sa nawawalang data. Super user-friendly, at laging maasahan ang support team nila. Wish we switched sooner!"

Related Posts

- Chelsea Cuevas

- October 14, 2025

Streamlining HR Operations with HRIS: Key Features to Look For

In today’s fast-paced business environment, efficiency is crucial, especially in human resour ..

- Justine Candelario

- October 14, 2025

Level Up Your HR Payroll with ERPat System

S truggling with payroll errors, compliance issues, and tedious manual processes? Traditional p ..